Abderrahim Bouazza, Director General of Bank Al Maghrib, disclosed that the value of bad debts owed by companies and households to leading banks has more than doubled in the past decade, exceeding 98 billion dirhams, or 8.6% of total bank loans and 7% of Morocco’s GDP.

He attributed this rise to several factors, including difficult economic conditions, sectoral problems, excessive debt, life emergencies, and mismanagement. Bouazza warned that bad debts could worsen in the future due to recent economic shocks, the full effects of which have yet to be reflected in bank financial statements, along with increasing international uncertainty.

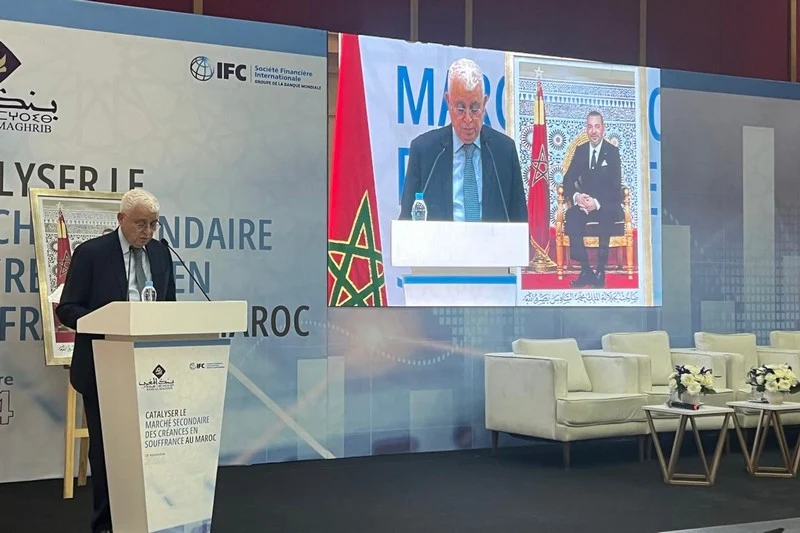

In his opening remarks at a workshop on stimulating the bad debt market, Bouazza noted that the restructuring of the debt classification and provisioning circular could worsen the situation.

Read also: Unpaid debts in Morocco and the new markets where they’ll be sold: explainer

He explained that bad debts stay on bank balance sheets for extended periods due to lengthy collection processes, both amicable and judicial. Tax rules prevent the removal of these debts until after five years and after exhausting all litigation options. The consequences include high management costs for banks, liquidity problems, and a freeze on funds required for financial stability.

Bouazza also highlighted the potential for a secondary market to help address the issue. Banks have liquidity needs close to 120 billion dirhams, and a secondary market for bad debts could provide up to 100 billion dirhams.

This market would allow banks to sell bad debts to professional investors, removing legal obstacles such as debtor consent and simplifying collection procedures. The draft law regulating the market is set to address these issues and be adopted soon.

David Tennell, Director of the International Finance Corporation (IFC), supported the creation of the bad debt market, noting that the draft law stems from efforts since 2019.

The IFC helped identify obstacles to establishing this market and assisted in preparing the project. Tennell emphasized that selling bad debts would enable banks to regain liquidity, which would improve their ability to issue new loans and enhance their risk margin.

Nabil Badr, Assistant Director at Bank Al-Maghrib, stressed that the bad debt market represents an opportunity to improve management.

He explained that reforms are needed to overcome legal, tax, and practical obstacles. Badr pointed out that Morocco’s bad debt ratio, at around 8.5%, is relatively high compared to countries like the U.S. and Switzerland, which highlights the need for reform.

He outlined two solutions for managing these debts: securitization, suitable for larger debt volumes but costly, and direct transfer, more accessible for smaller investors. Legal and tax reforms are essential to establishing a secondary market for distressed debts.

The post Bank Al-Maghrib tackles surge in bad debts with new secondary market proposal appeared first on HESPRESS English – Morocco News.

No products in the cart.

No products in the cart.